Table of Contents

In the rapidly evolving world of financial technology (FinTech), regulatory landscapes are constantly shifting as governments strive to balance innovation with stability and consumer protection. One country that has emerged as a leader in navigating this complex terrain is Singapore. With its proactive and pragmatic approach to FinTech regulation, the city-state offers valuable lessons for other jurisdictions grappling with similar challenges.

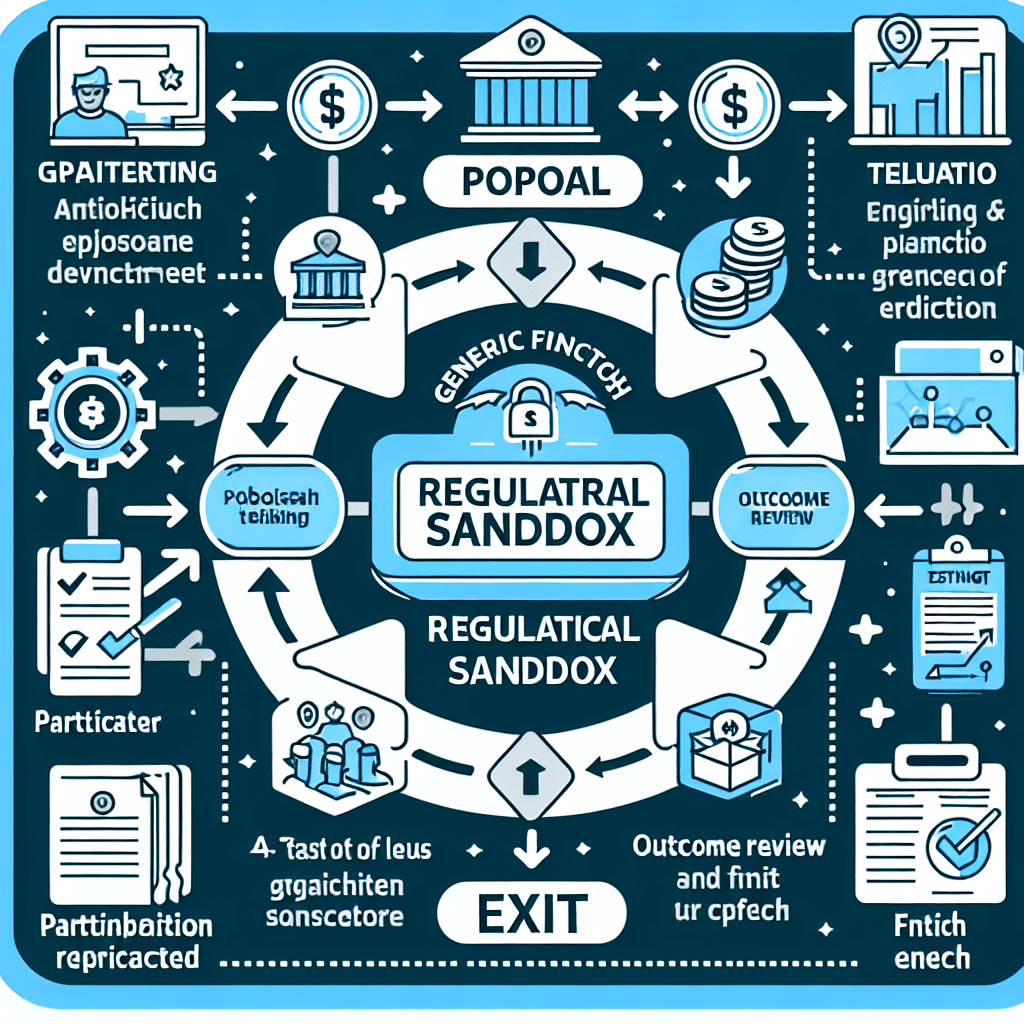

Singapore’s FinTech Regulatory Sandbox

One of the most significant regulatory initiatives spearheaded by the Monetary Authority of Singapore (MAS) is the FinTech Regulatory Sandbox. Launched in 2016, this sandbox provides a controlled environment where FinTech firms can test innovative products and services without being subject to the full gamut of regulatory requirements.

As Sopnendu Mohanty, Chief FinTech Officer at MAS, explains: “The sandbox allows us to facilitate innovation in a safe environment, while maintaining the necessary safeguards to protect consumers and the financial system.”

Key Features of the Sandbox

The sandbox operates on a case-by-case basis, with MAS assessing each application based on its merits and potential risks. Some key features include:

- Tailored regulatory requirements

- Defined testing parameters and duration

- Safeguards to contain potential risks and losses

- Close monitoring and supervision by MAS

By providing a controlled space for experimentation, the sandbox enables FinTech firms to validate their concepts and refine their business models before a full-scale launch. This approach not only supports innovation but also allows regulators to identify and address potential risks early on.

Collaborative Regulation and Industry Engagement

Another hallmark of Singapore’s approach to FinTech regulation is its emphasis on collaboration and industry engagement. MAS actively seeks input from FinTech firms, financial institutions, and other stakeholders when developing regulatory frameworks and guidelines.

For instance, in 2018, MAS established the FinTech Advisory Committee, comprising local and international experts, to advise on strategies to foster a vibrant FinTech ecosystem. The committee’s insights have helped shape initiatives such as the Financial Services Industry Transformation Map, which outlines Singapore’s vision for the future of finance.

MAS also regularly organizes events and forums, such as the Singapore FinTech Festival, to facilitate dialogue and knowledge-sharing among FinTech players, regulators, and investors. These platforms not only showcase Singapore’s FinTech capabilities but also provide valuable opportunities for regulatory authorities to stay attuned to industry developments and concerns.

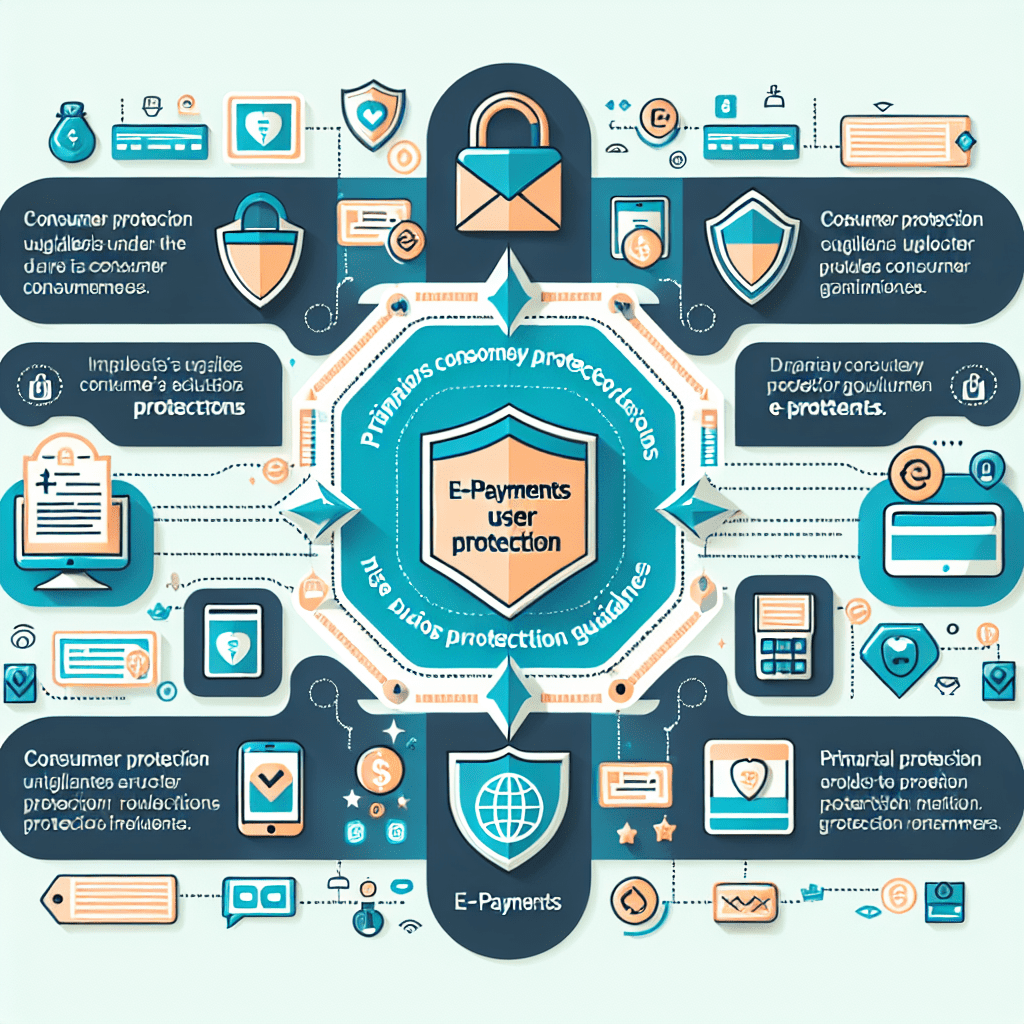

Balancing Innovation and Consumer Protection

While fostering innovation is a key priority, Singapore’s regulators are equally committed to safeguarding consumer interests and maintaining financial stability. This balance is evident in the targeted regulatory measures introduced in recent years.

Payment Services Act

In 2019, Singapore passed the Payment Services Act (PSA), which streamlines the regulation of payment services under a single legislation. The PSA adopts a risk-based approach, subjecting different types of payment services to proportionate regulatory requirements based on their risks.

As Ravi Menon, Managing Director of MAS, notes: “The Payment Services Act provides a forward-looking and flexible regulatory framework for the payments industry. It will facilitate innovation while mitigating risks and fostering confidence in our payments landscape.”

E-Payments User Protection Guidelines

To enhance consumer protection in the digital payments space, MAS issued the E-Payments User Protection Guidelines in 2019. These guidelines set out standards for financial institutions to protect consumers from unauthorized or erroneous transactions.

Key measures include:

- Requirement for financial institutions to provide timely notifications of e-payment transactions

- Liability shift from consumers to financial institutions for unauthorized transactions

- Streamlined dispute resolution processes

By implementing such targeted regulations, Singapore aims to create a safe and trusted environment for consumers to embrace FinTech innovations while mitigating potential risks.

Nurturing FinTech Talent and Capabilities

Singapore recognizes that a robust FinTech ecosystem requires not only a conducive regulatory environment but also a strong talent pipeline. To this end, MAS and other government agencies have launched various initiatives to develop FinTech skills and capabilities.

FinTech Talent Program

In 2016, MAS introduced the FinTech Talent Program to help finance professionals acquire the necessary skills to transition into FinTech roles. The program offers training in areas such as blockchain, artificial intelligence, and data analytics, equipping participants with the knowledge and tools to drive FinTech innovation.

Global FinTech Hackcelerator

MAS also organizes the annual Global FinTech Hackcelerator, a competition that challenges participants to develop innovative solutions to real-world financial sector problems. The event attracts talent from around the world, fostering cross-border collaboration and knowledge-sharing.

As Jacqueline Loh, Deputy Managing Director of MAS, emphasizes: “Nurturing a deep pool of FinTech talent is crucial to the success of Singapore’s FinTech ecosystem. By equipping professionals with the right skills and providing platforms for innovation, we can drive the transformation of the financial sector and create new opportunities for growth.”

Lessons and Implications

Singapore’s approach to FinTech regulation offers several key lessons for other jurisdictions:

-

Adopt a proactive and collaborative stance: Engage with industry stakeholders, seek feedback, and stay attuned to market developments to craft responsive and effective regulations.

-

Implement risk-based and proportionate regulations: Tailor regulatory requirements to the specific risks posed by different types of FinTech activities, avoiding a one-size-fits-all approach.

-

Foster innovation through sandboxes and experimentation: Provide controlled environments for FinTech firms to test and refine their solutions, enabling innovation while managing risks.

-

Prioritize consumer protection: Implement targeted measures to safeguard consumer interests, such as liability frameworks and dispute resolution mechanisms, to build trust in FinTech solutions.

-

Invest in talent development: Cultivate a strong FinTech talent pipeline through training programs, hackathons, and other initiatives to drive innovation and growth.

As the FinTech landscape continues to evolve, regulators worldwide will need to remain agile and responsive to emerging challenges and opportunities. By learning from Singapore’s experience and adapting its approaches to their specific contexts, other jurisdictions can strive to create enabling environments for FinTech innovation while upholding the integrity and stability of the financial system.

Conclusion

Singapore’s journey in navigating FinTech regulatory changes offers a compelling case study of how proactive and collaborative regulation can foster innovation while safeguarding consumer interests. Through initiatives such as the FinTech Regulatory Sandbox, targeted legislation, and talent development programs, Singapore has positioned itself as a global leader in FinTech.

As Ravi Menon aptly summarizes: “We want to create a regulatory environment that is conducive for innovation and experimentation in FinTech, while providing the necessary safeguards to protect consumers and maintain the stability of our financial system. This is a delicate balance, but one that we believe is achievable with a collaborative and progressive approach.”

As other jurisdictions navigate their own FinTech regulatory journeys, Singapore’s experience offers valuable insights and lessons. By embracing a proactive, risk-based, and collaborative approach to regulation, countries can unlock the transformative potential of FinTech while ensuring a stable and trustworthy financial ecosystem for all stakeholders.