Table of Contents

In the rapidly evolving landscape of personal finance, artificial intelligence (AI) has emerged as a game-changing technology, offering unprecedented opportunities for Americans to optimize their financial well-being. From intelligent budgeting apps to personalized investment advice, AI-powered tools are revolutionizing the way individuals manage their money. This article delves into the most effective AI-driven personal finance solutions available in the United States, highlighting their benefits and providing insights on how to leverage them for maximum financial success.

The Rise of AI in Personal Finance

The integration of AI in personal finance has been a natural progression, given the technology’s ability to process vast amounts of data, identify patterns, and provide predictive insights. As Lex Sokolin, Global Fintech Co-Head at ConsenSys, notes, “AI is the new electricity for financial services. It has the potential to transform every aspect of how we interact with money.”

The growing adoption of AI in personal finance is evident from the surge in funding for AI-focused fintech startups. According to a report by CB Insights, global AI in fintech funding reached $4.1 billion in 2020, despite the pandemic-induced economic uncertainties.

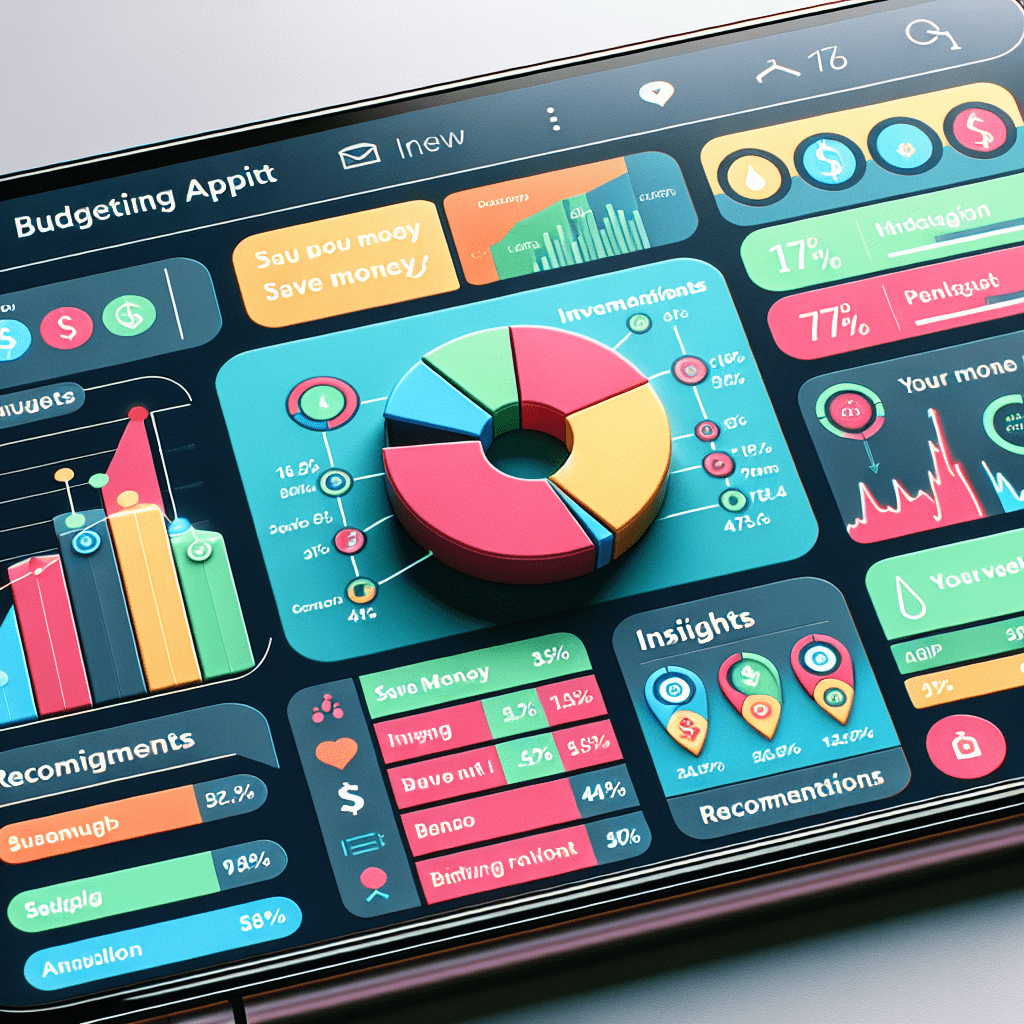

Intelligent Budgeting and Expense Tracking

One of the most popular applications of AI in personal finance is in the realm of budgeting and expense tracking. Apps like Mint, PocketGuard, and YNAB (You Need A Budget) leverage machine learning algorithms to automate the categorization of transactions, provide personalized budget recommendations, and alert users when they’re likely to overspend.

These AI-powered tools offer a comprehensive view of an individual’s spending habits, helping them identify areas where they can cut back and save more. For example, PocketGuard’s AI analyzes a user’s income and spending patterns to determine how much money they have available for daily expenses, bills, and savings goals.

AI-Driven Investment Advice

Another area where AI is making significant inroads is in investment advice. Robo-advisors like Betterment, Wealthfront, and Vanguard Personal Advisor Services use AI algorithms to create personalized investment portfolios based on a user’s risk tolerance, financial goals, and time horizon.

These platforms employ sophisticated algorithms to continually monitor and rebalance portfolios, ensuring optimal asset allocation and risk management. By automating the investment process and reducing the need for human intervention, robo-advisors can offer lower fees compared to traditional financial advisors, making professional investment management accessible to a wider audience.

Predictive Financial Planning

AI is also powering innovative tools that enable predictive financial planning. Apps like Digit and Qapital use machine learning to analyze a user’s income and spending patterns, predict future cash flows, and automatically set aside money for savings goals or upcoming expenses.

By leveraging AI’s predictive capabilities, these tools help users avoid overspending and ensure they’re always prepared for anticipated financial obligations. As Ethan Bloch, founder and CEO of Digit, explains, “Our AI looks at your spending patterns, learns from them, and then automatically moves money into your savings account when you’re not likely to need it.”

Fraud Detection and Security

AI plays a crucial role in enhancing the security of personal finance applications and detecting fraudulent activities. Banks and financial institutions employ AI-powered systems to monitor transactions in real-time, identify suspicious patterns, and flag potential fraud.

For example, AI algorithms can detect anomalies in a user’s spending behavior, such as unusual purchases or transactions from unfamiliar locations, and promptly alert the user and the financial institution. This proactive approach to fraud detection helps minimize financial losses and protects users’ sensitive information.

Challenges and Considerations

While AI offers numerous benefits in personal finance, it’s essential to be aware of potential challenges and considerations. One concern is the issue of data privacy, as AI-powered tools rely on access to users’ sensitive financial information. It’s crucial for individuals to carefully review the privacy policies of the apps and platforms they use and ensure that their data is being handled securely.

Another consideration is the potential for AI bias, where algorithms may make decisions that inadvertently discriminate against certain groups of users. To mitigate this risk, it’s important for AI-powered financial tools to be developed and tested with diverse datasets and to undergo regular audits to identify and correct any biases.

Conclusion

The integration of AI in personal finance is transforming the way Americans manage their money, offering powerful tools for budgeting, investing, and financial planning. By leveraging the capabilities of AI, individuals can gain deeper insights into their financial habits, make more informed decisions, and ultimately achieve their financial goals more effectively.

As the AI landscape continues to evolve, it’s essential for users to stay informed about the latest developments and to carefully evaluate the tools they use to ensure they align with their needs and values. With the right approach and a commitment to responsible AI adoption, Americans can harness the power of this transformative technology to build a more secure and prosperous financial future.