Table of Contents

In today’s fast-paced digital world, managing personal finances has become both easier and more complex. With a myriad of financial products, services, and investment opportunities at our fingertips, making sound financial decisions can be overwhelming. This is where artificial intelligence (AI) is revolutionizing the game, particularly in India’s dynamic and rapidly evolving consumer landscape.

AI-powered personal finance tools are emerging as a game-changer, empowering individuals to take control of their financial well-being like never before. These smart applications leverage advanced algorithms, machine learning, and data analytics to offer personalized insights, automate financial tasks, and provide data-driven advice tailored to each user’s unique financial situation.

The Rise of AI in Personal Finance

The integration of AI in personal finance is not a futuristic concept; it’s already here and rapidly gaining traction. According to a report by McKinsey Global Institute, AI could potentially add $13 trillion to the global economy by 2030, with the financial services sector being one of the primary beneficiaries.

In India, the adoption of AI in fintech is witnessing significant growth. The country’s thriving startup ecosystem, coupled with a tech-savvy population and increasing smartphone penetration, has created a fertile ground for AI-driven financial innovations. From budgeting apps to investment advisors, AI is transforming how Indians manage their money.

Personalized Budgeting and Expense Tracking

One of the most popular applications of AI in personal finance is budgeting and expense tracking. Apps like Walnut and Fyle leverage machine learning algorithms to automatically categorize transactions, identify spending patterns, and provide personalized insights to help users make informed financial decisions.

These apps can also send smart notifications, reminding users of upcoming bills, alerting them when they’re close to exceeding their budget, and offering tips to cut down on unnecessary expenses. By providing a comprehensive overview of one’s financial health, AI-powered budgeting tools enable users to take proactive steps towards better money management.

Intelligent Investment Advisory

Investing is another area where AI is making significant strides. Traditionally, investment advice was the domain of human financial advisors, often accessible only to high-net-worth individuals. However, AI-driven investment platforms, such as Scripbox and Kuvera, are democratizing access to personalized investment recommendations.

These platforms use AI algorithms to analyze vast amounts of market data, consider individual risk profiles and financial goals, and generate tailored investment strategies. They can also automate portfolio rebalancing and provide real-time alerts on market movements, helping users make timely investment decisions.

As Aniruddha Malpani, an angel investor and startup advisor, notes, “AI is leveling the playing field in personal finance. It’s enabling the average investor to access the same quality of investment advice that was previously available only to the wealthy.”

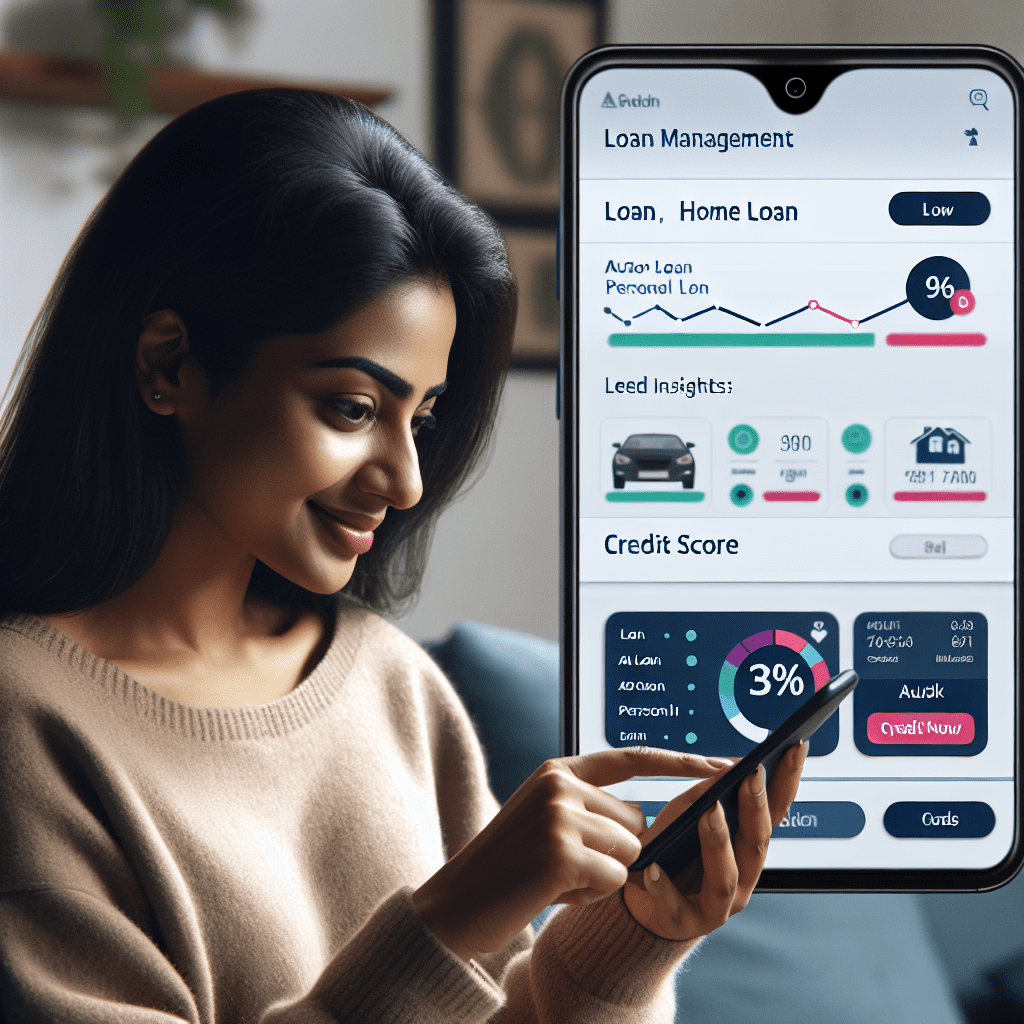

Smarter Loan Management

AI is also transforming the way individuals manage their loans and credit. Apps like CreditMantri and PaySense use machine learning to assess creditworthiness, offering personalized loan options based on a user’s financial profile. These platforms can also provide guidance on improving credit scores and suggest debt repayment strategies.

Moreover, AI-powered chatbots are simplifying the loan application process, providing instant assistance and resolving queries in real-time. This not only enhances user experience but also improves financial inclusion by making loan services more accessible to a wider population.

Fraud Detection and Security

With the rise of digital transactions, ensuring the security of financial data has become paramount. AI plays a crucial role in detecting and preventing fraudulent activities in real-time. Banks and fintech companies are leveraging machine learning algorithms to identify unusual transaction patterns, flag suspicious activities, and protect users from potential financial losses.

AI-based security systems can also learn from past incidents and continuously improve their fraud detection capabilities. This adaptive nature of AI makes it an indispensable tool in safeguarding users’ financial information in an increasingly digital world.

Challenges and the Way Forward

While the potential of AI in personal finance is immense, it’s not without challenges. Data privacy and security concerns, algorithmic biases, and the need for robust regulations are some of the key issues that need to be addressed as AI becomes more pervasive in the financial sector.

Moreover, as AI takes over more financial tasks, there is a need to ensure that users retain control over their financial decisions. AI should be seen as a tool to augment human intelligence rather than replace it entirely. Financial literacy and user education will play a crucial role in helping individuals leverage AI effectively while making informed decisions.

Conclusion

The integration of AI in personal finance is ushering in a new era of financial empowerment for Indian consumers. From personalized budgeting and investment advice to smarter loan management and enhanced security, AI-powered tools are reshaping how individuals interact with their money.

As Nandan Nilekani, co-founder of Infosys and former chairman of UIDAI, rightly states, “AI has the potential to drive financial inclusion and empower millions of Indians to take control of their financial lives. It’s not just about convenience; it’s about enabling better financial outcomes for all.”

As AI continues to evolve and mature, it holds the promise of transforming personal finance in India, making it more accessible, personalized, and efficient. By embracing these AI-driven innovations, Indian consumers can unlock new opportunities, make smarter financial decisions, and pave the way for a more financially secure future.